Market Access

All markets are open to you

Do you need additional volumes of electricity? Or would you like to take advantage of price fluctuations on the electricity market to purchase electricity cost-effectively or to market generation plants profitably? Our in-house 24/7 electricity trading gives you access to all relevant European electricity markets without having to make major investments: We open the door to the EEX derivatives market in Leipzig, the day-ahead and intraday auctions of the EPEX SPOT power exchange, the balancing energy market of transmission system operators, other international electricity markets and our OTC partners.

Aligned with your needs

You decide yourself to what extent you wish to make use of our services: Maybe you just want to save the costs for your own market access, but want to act completely independently on the stock exchange. Then simply let us know what volumes of electricity we should buy or sell for you and where. Or you can use our trading platform NEXTRA to trade on the stock exchange yourself. Or perhaps you would like to use the expertise of our trading team or forecasts on price developments on the electricity trading venues to manage your portfolio more profitably or to smooth out your balancing groups. We are guided by your requirements.

Derivatives market

Medium- and long-term electricity trading

Longer-term supply contracts are concluded on the EEX derivatives market in Leipzig. The so-called futures can be traded as base or peak products with delivery periods of one calendar week, one calendar month, one quarter and one calendar year - up to six years in advance. Our market access enables you to purchase or sell standard electricity products or structure your portfolio in the medium to long term.

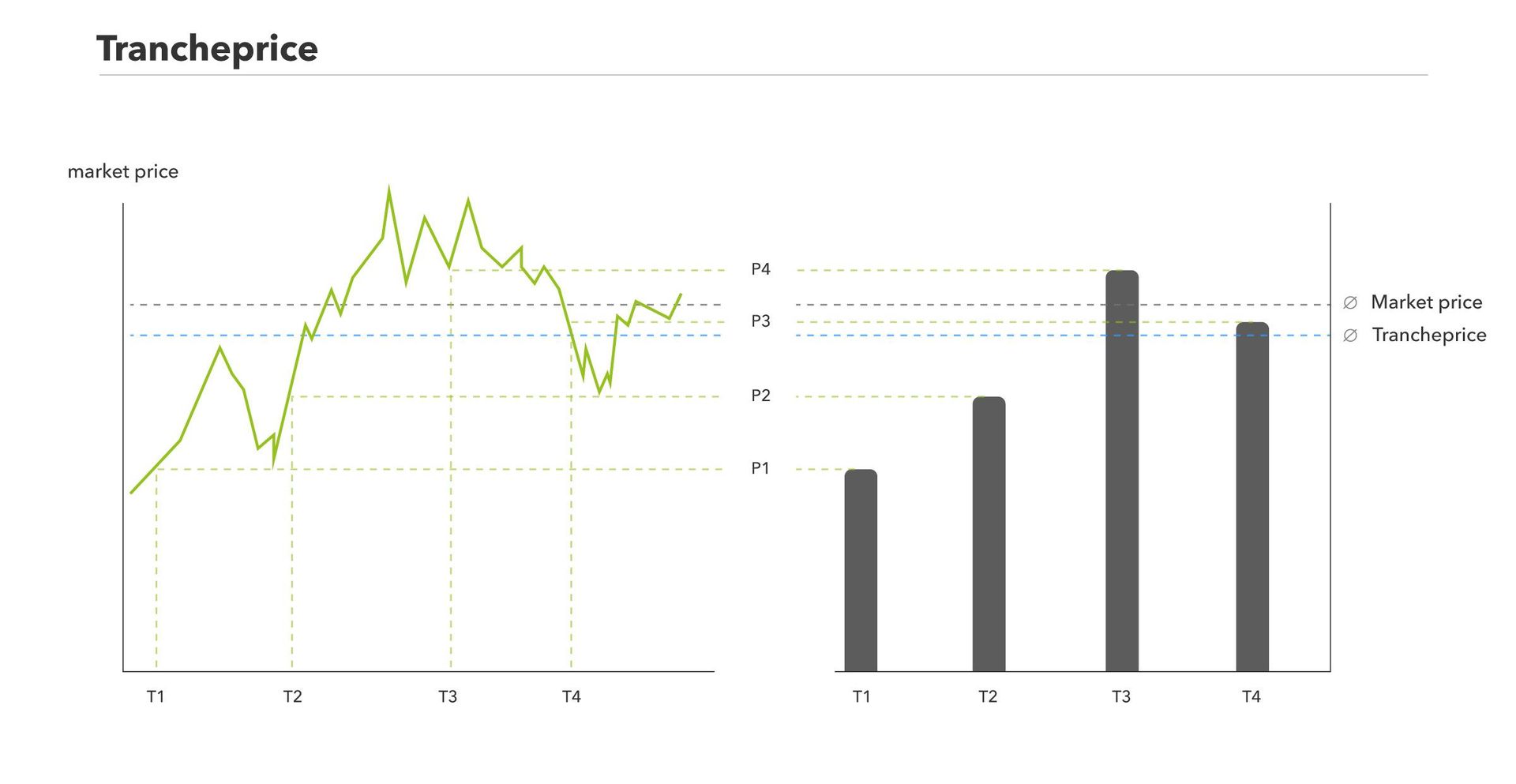

Tranche delivery: If you have a high power requirement, it is often worthwhile to cover this in several subsets using a tranche model. By spreading your electricity procurement over the entire year, you can react to the current market situation and thus significantly reduce your price risk. Of course, you can also fix the entire quantity at low prices. You can determine the purchase dates for the tranches yourself and place your order via our market access. On request, we can also support you in the development and implementation of your purchasing strategy. This way you benefit from falling electricity prices without having to continuously observe the market.

Full Service: We handle the trading business for you. Billing is based on current market prices.

Trading: You define the time and quantity of the purchase or sale according to your requirements. You transmit your order via a secure e-mail, SFTP server, a REST interface or our customer portal NEXTRA.

Spot market

Short-term optimisation of your portfolio

On the spot market for energy, the EPEX Spot in Paris, electricity volumes available at short notice are traded. The electricity volumes are either sold one day before physical delivery in day-ahead trading or traded on the intraday market on the day of physical delivery. With us, you can react flexibly to short-term fluctuations in consumption and generation in your portfolio and adjust your trading volumes - without investing in your own stock exchange access.

Day-Ahead: You gain access to the day-ahead auction and can trade full hours or block bids for the next day according to your needs (for example, base or peak load) - from a minimum quantity of 0.1 MW up to a contractually agreed maximum capacity. The intersection of demanded and offered quantity results in the market clearing price, which is then paid out for the respective product.

Intraday: Trade power in 15-minute, hourly, or standard blocks (for example, peak or baseload). You can trade a position up to 5 minutes before maturity. The smallest tradable unit in intraday trading is 0.1 MW, and the possible price range for a megawatt hour is -9,999 euros to 9,999 euros. You receive or pay the bid price that was awarded in the respective transaction.

Balancing group management: Intraday trading offers you the opportunity to offset shortfalls or surpluses in your own balancing group by short-term, intraday trading activities. In addition, you can use short-term trading to produce the electricity of your customers' own generation plants or plants as required - and thus as profitable and system-stabilizing as possible.

Control energy

Trading control power and stabilizing the grid

The decentralized systems in your portfolio or in the portfolio of your customers have a valuable potential: controllability. In contrast to solar and wind plants, biogas, water or CHP plants, for example, can produce more or less electricity in the short term. This controllability is worth money on the balancing energy market. As a long-standing provider of control energy in all four German control zones, we market the flexibility of your plants via our virtual power plant both on the minute reserve market and on the more lucrative secondary and primary reserve markets. Of course, you retain the sovereignty over your investments.

Control energy marketing: We connect your plants to the control system of our virtual power plant and carry out the necessary test procedure. The provision of the plants is remunerated with a standby fee, the so-called performance price. This has no effect on the mode of operation. In the event of fluctuations in the power grid, the output of the plants is adjusted accordingly and an energy price is paid in addition to the capacity price.

White Label: Would you like to act as a direct marketer and virtual power plant for your customers? No problem! We also offer you the complete management of the systems you bring in as a white label solution. From the production of remote control to the optimization of the systems to trading - we make our entire know-how available to you.

NEXTRA

Trading platform

NEXTRA is our trading platform that gives you 24/7 access to the electricity markets and allows you to settle all your trading transactions conveniently and comfortably. In addition, you can use NEXTRA to upload and analyze various data and derive forecasts from it.

Data and forecasts: Perfect overview of your portfolio and forecasts individually tailored to you.

Balance group balance: Balance your balance group directly via NEXTRA.

Place Order: On the platform you can directly place your order for the intraday auction.

Next Portal

Our Customer Portal

With our customer portal we offer you a maximum of transparency. Here you can view and manage the status of your installations at any time and conveniently call up your data and accounts. This also enables you to track your additional revenue. You can use "Next Portal" with all current operating systems and browsers. My Power Plant is also available as an app for Apple and Android devices.

Market Access

Frequently asked questions

Here you will find answers to many questions about electricity trading. We will also be happy to answer your questions personally. Just get in touch with us!

Next Kraftwerke gives you access to all relevant European electricity trading venues without having to make major investments or hire specialists. Next Kraftwerke can act for you at the electricity trading places and you can always keep an overview of the activities carried out for you via NEXTRA. In addition, NEXTRA offers the possibility to trade in the short and long term markets.

Next Kraftwerke gives you access to a wide variety of electricity trading places: futures market, day-ahead trading and also for continuous intraday electricity trading. These trading venues include EPEX Spot, the EEX derivatives market and international electricity exchanges such as the Austrian electricity exchange EXAA. We can also offer you access to our OTC partners and provide you with access to your flexible portfolio on the balancing energy markets.

No. For market access organised by Next Kraftwerke, there are no separate entry requirements to be met, except for appropriate creditworthiness.

Next Kraftwerke opens the door to the European energy markets. This means that you do not have to bear the costs of an IPO yourself and benefit from our know-how as an experienced electricity trading company. Market access services are the basis for using one of our other energy services and thus form the basis for saving further costs, minimizing risks or managing your portfolio more profitably. Optionally, you can use our trading portal NEXTRA and operate on the markets, analyze and monitor data.

Access costs for the various trading venues are an investment you do not want to make? Market access via Next Kraftwerke minimizes these costs. Our service fee is based on the volumes we trade for you. This means: You save the stock exchange setup costs as well as expenses for infrastructure and personnel and still have access to the market price.

With our simplest service, market access, you tell us what quantities of electricity we should buy or sell where for you or you simply trade the quantities yourself via our energy trading portal NEXTRA. Communication can take place via secure e-mail, FSTP server, a REST interface or our customer portal NEXTRA (link to trading.next-kraftwerke.com). You make all decisions yourself. Should you also wish to make forecasts about your consumers and producers as well as about price developments at the electricity trading centres, you can make use of one of our other services. We will be happy to advise you individually on the possibilities and opportunities.

Numbers & Facts

Employees

Connected Technologies

Aggregated Units

Networked Capacity

Foundation

Volume of traded energy

We are Next Kraftwerke

We operate our trading floor at our headquarters in Cologne (Germany). Whether you need to market your portfolio, procure electricity or close out your balancing group - our trading experts handle all energy industry processes for you with the highest level of market expertise and expertise. Since we are not intertwined with the structures of the old energy industry, you retain your own profile and strategic independence in the cooperation.