Balancing group management & portfolio management

Individually tailored to your needs

With our in-house electricity trading and many years of experience as a balancing group manager, we offer you suitable solutions for your balancing group management and portfolio management - from marketing your residual profile to complete balancing group management.

Diverse data for better forecasts

Whether you just want to market your residual profile through us or transfer the complete balancing group management to our trading team - we offer you the individually tailored solution for your balancing group management and portfolio management. This allows you to concentrate entirely on your core business while at the same time ensuring that all obligations - such as the quarter-hourly management of your own balancing group - are fulfilled with the utmost care and market knowledge.

What makes us different: For our forecasts, we not only use stock market data from numerous trading venues and weather data from our own meteorological analyses. We can also access live feed-in and feed-out data from thousands of plants in our virtual power plant and are thus one step ahead of other service providers in forecasting.

Balancing group management

Remaining in balance despite increased requirements

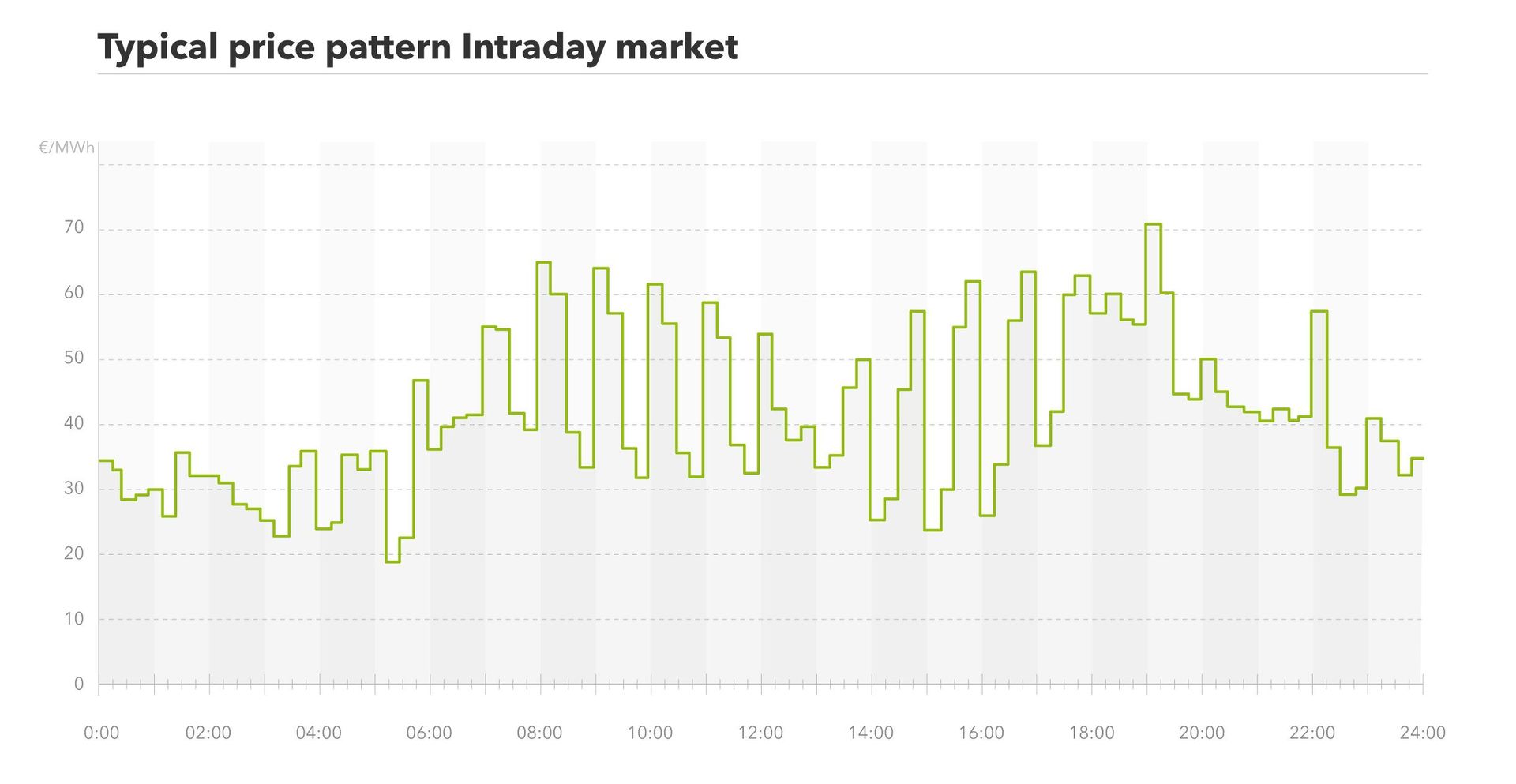

The authorities' requirements for balancing group management have increased significantly in recent years. For example, the obligation to manage balancing groups to the nearest quarter of an hour is being pursued more and more strictly. Thanks to our access to intraday markets and many years of know-how as balancing group managers, we can effectively relieve you.

Full-Service: On request, we take over the complete balancing group management for you - taking into account all BRP requirements - including portfolio risks.

Guaranteed performance: We guarantee quarterly accurate balancing group management in accordance with all guidelines and regulations.

Safe implementation: In energy data management, we ensure the plausibility of your feed and extraction data and prepare them for further processing.

Communication inclusive: We take care of communication with the respective balancing group coordinator - taking into account the obligatory data transmission procedures.

24 hours availability: We guarantee 24-hour availability for timetable communication. In the event that the TSO reports an error in our timetable data or those of our trading partners, we can react immediately and make corrections if necessary.

Portfolio management

Precise forecasting, targeted readjustment

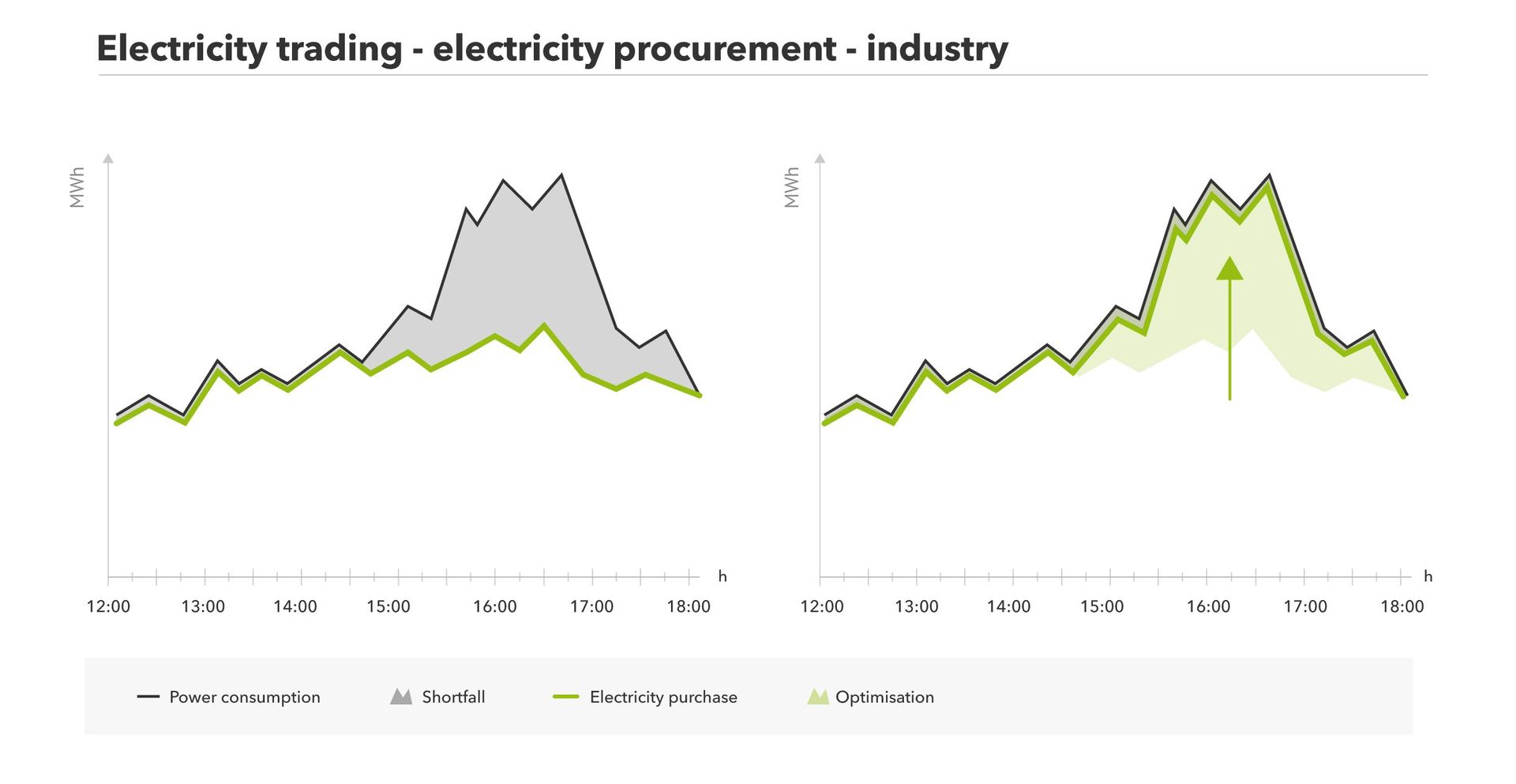

In portfolio management, we adjust two important levers for you: First, we optimize your generation and consumption forecasts by including as much meaningful data as possible in the forecast. On the following day we will then bring together the timetables that have been forecasted and implemented. Through the short-term trading of required or surplus quantities of electricity on the intraday market, we reliably smooth out your balancing group. The result: Your balancing energy risks decrease, your balance group loyalty increases.

Accurate forecasts: You benefit from precise forecasts based on meaningful data - regardless of whether your load profile is measured by automated meter reading (AMR) or predicted using a standard load profile (SLP).

Coordination with TSO: We coordinate the forecasted and finally realized timetables in the timetable management with the responsible TSO.

Short-term compensation: Thanks to our 24/7 electricity trading and access to intraday trading, we bring together your forecast and realised schedules in a dynamic process - this saves you work and additional balancing energy costs.

Individualized procurement strategies: On request, we develop individualized procurement strategies together with you.

NEXTRA

The trading platform

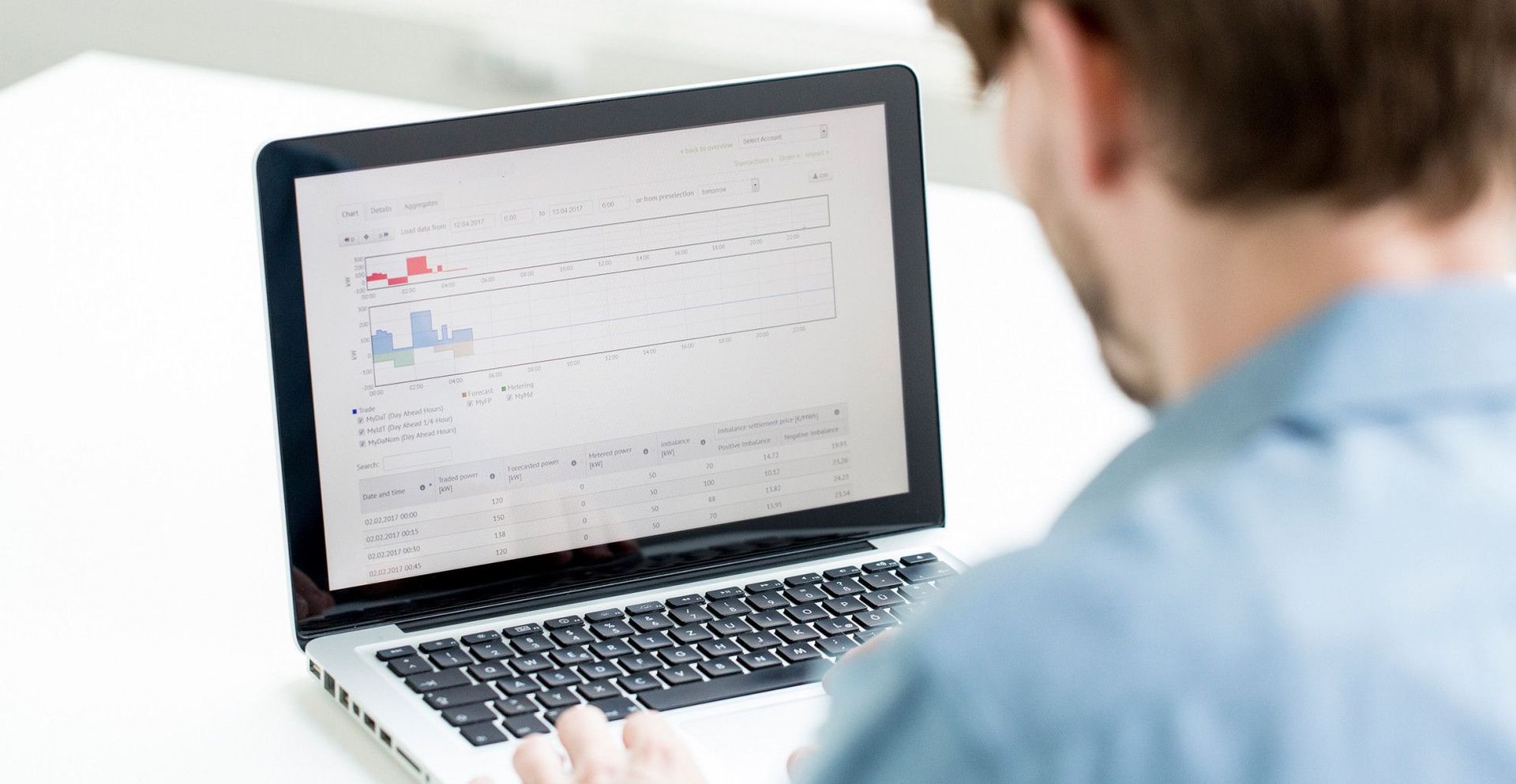

NEXTRA is our trading platform, which you can use entirely according to your needs. If we take over your balancing group management, NEXTRA provides you with an overview of the activities carried out for you as a practical monitoring tool.

Data and forecasts: You can view forecasts that are individually tailored to you.

Balance your balancing group: Balance your balancing group directly via NEXTRA.

Place order: On the platform you can directly place your order for the intraday auction.

FAQ Balancing group management & portfolio management

Frequently asked questions

Here you will find answers to many questions about balancing group management and portfolio management. We will also be happy to answer your questions personally. Just get in touch with us!

As balancing group manager, you have to fulfil a large number of obligations, the scope of which has increased considerably in recent years. Next Kraftwerke can support you in managing your balancing group. You are free to decide whether we should take over part of your tasks or the complete balancing group management. With NEXTRA, you can also easily manage your balancing group yourself: coordinate your own portfolio data with the constantly updated data from our trading floor and balance your portfolio.

The balancing group management tasks that Next Kraftwerke can take over for you include:

- Quarterly balancing group management in compliance with all guidelines and regulations

- Energy data management - here the plausibility of your feed and extraction data is ensured and they are also prepared for further processing

- Communication with the balancing group coordinator. Next Kraftwerke also takes care that the obligatory data transmission is observed

- 24-hour availability for timetable communication. In the event that the TSO reports an error in the transmitted timetable data or the data of our trading partners, we can react immediately and make corrections if necessary.

- Complete balancing group management taking into account MaBiS requirements and portfolio risks

- With NEXTRA, Next Kraftwerke provides a clear overview of relevant data that you can coordinate with your own data. You can also use NEXTRA to directly balance your balancing group and view forecasts tailored to your needs. You leave balancing group management to Next Kraftwerke? Here, too, NEXTRA is a useful tool to get an overview of the activities carried out for you and to monitor them.

You can put together or combine the various services as you wish and thus benefit from the experience of Next Kraftwerke as a trading partner and balancing group manager.

Yes, you can remain balancing group manager. In this case, if you wish, we will gladly market your residual profile and smooth out the quarter-hours you have already traded, or carry out other tasks as a service provider. Or you can easily meet your obligations as balancing group manager via our trading portal NEXTRA.

In addition to a relief, since you now have to take on fewer balancing group management tasks and can therefore concentrate on your core business, you also benefit from Next Kraftwerke' many years of experience and know-how. Your risks are also reduced. Your risk of an unbalanced balancing group and the associated compensation payments is reduced by constant optimisation and adjustments of our forecasts during the day as well as the 24-hour readiness. In case of schedule inconsistencies, our experienced schedule management team takes over the problem solution and direct communication with the transmission system operators/balancing group coordinators in order to avoid sometimes expensive balancing energy costs and to ensure a balanced balancing group.

This cannot be answered across the board. The price of balancing group management depends on the one hand on the service taken over for you and on the other hand on the characteristics of your balancing group. In addition, you decide yourself whether you would rather bear the remaining balancing energy costs or have the risks covered by a lump sum. Please feel free to contact our specialists for individual advice and we will put together suitable services for you.

Balancing group totals time series are made available to you. This allows you to track at any time what activities we have undertaken to smooth out your balancing group. Or you can use NEXTRA to view the activities or become active yourself.

There is no such thing as only one portfolio management. Because just as unique as your portfolio is its management. Next Kraftwerke offers you support for the preparation of generation and consumption forecasts. The basis of the forecasts is the large amount of meaningful data, such as forecasts at the electricity trading centres or information from our power plant pool, which we collect and interpret and make available to you on our customer platform NEXTRA. In a second step, we will bring these forecasts in line with the timetables realised on the following day. Through the short-term trading of required or surplus quantities of electricity on the intraday market, we can smooth out your balancing group. The result is a higher balance group loyalty and reduced risks for the balancing energy.

One of the core competencies of Next Kraftwerke is the preparation of forecasts. Among other things, we are experts in the preparation of high-quality and reliable forecasts of volatile renewable energies and their continuous updates, as a basis for continuous intraday trading. Whether your load profile is predicted using Recording Power Measurement (RLM) or a standard load profile (SLP), Next Power Plants can help you create forecasts based on meaningful data. In timetable management, we coordinate the timetables forecast and implemented in this way with the TSO. By trading electricity 24 hours a day, 7 days a week, 365 days a year and operating in short-term intraday markets, we can align forecasts with your actual schedules. Your advantages are: saved resources, since you do not have to deal with this continuous task yourself, as well as minimized risks of an unbalanced balancing group due to the accuracy of the forecasts and continuous optimization. As balancing group manager, you must fulfil the obligations to manage balancing group on a quarter-hour basis in accordance with Section 4 (2) (5) of the standard balancing group contract. We can do this for you! Next Kraftwerke can also work with you to develop an individualised procurement strategy that is perfectly tailored to your situation and market environment.

The portfolio management portal NEXTRA offers you the possibility to manage your portfolio optimally yourself. You get 24/7 access to the European energy markets and can become active there without having to invest in your own trading infrastructure. You can also enter your portfolio data. Together with real-time data and forecasts provided by Next Kraftwerke, you can get the most out of your portfolio. Access to NEXTRA is either via API or the Web Frontend. Several users can also work simultaneously with NEXTRA to optimize their portfolio management.

Portfolio management is closely interwoven with balancing group management. You can put together the various services grouped under the keywords portfolio or balancing group management as you wish. While portfolio management maps the trading, buying and selling strategies individually according to specially defined logics of the individual market players in the energy industry, balancing group management is geared to regulatory requirements.

Numbers & Facts

Employees

Locations

Aggregated Units

Networked Capacity

Foundation

Volume of traded energy

We are Next Kraftwerke

As a certified electricity trader, we open the door to the day-ahead and intraday markets of the electricity exchange EPEX Spot, to the balancing energy market of the transmission system operators and to other international electricity markets. Our traders are active here every day to support and relieve you in your energy management tasks. By the way: We are not interwoven with the structures of the old energy industry - this way you retain your own profile and strategic independence when working with us.