What is a Balancing Responsible Party (BRP) / Access Responsible Party (ARP)?

Definition

The responsibility for maintaining the instantaneous balance between generation and consumption of electricity lies with the transmission system operator (TSO). The TSO has to assure that the control area they are responsible for is in balance. In Belgium there is only one control zone that is covering the whole country and is overlooked by Elia. The control area does not necessarily have to cover a whole country. For example, in Germany there are four zones. To assure the balance in the control area is maintained, Elia outsources this responsibility to the so-called Balance Responsible Parties (BRPs, in Belgium also called ARPs for Access Responsible Parties). A BRP is a private legal entity that overlooks the balance of one or multiple access points to the transmission grid. The BRPs portfolio is also called the balancing group. The BRP composes a balanced portfolio by combining injection, off-take, exchange with other BRPs and possibly in- or export to another control area. Each generator and off-taker in the grid is obliged to have a contract with a BRP/ARP. Alternatively, they can be their own balancing responsible party.

Table of Contents

Example

To illustrate the role of a BRP, consider the following example. An electricity supplier buys his electricity from a wind farm in an over the counter contract. The day itself, say a windy Friday, there is low household demand and high wind production. Assuming the supplier is also its own BRP, his balancing group is composed of the injection by the wind farm, the offtake from the connected households and the trades with other BRPs via the power market. At all times he is responsible for the balance of this balancing group.

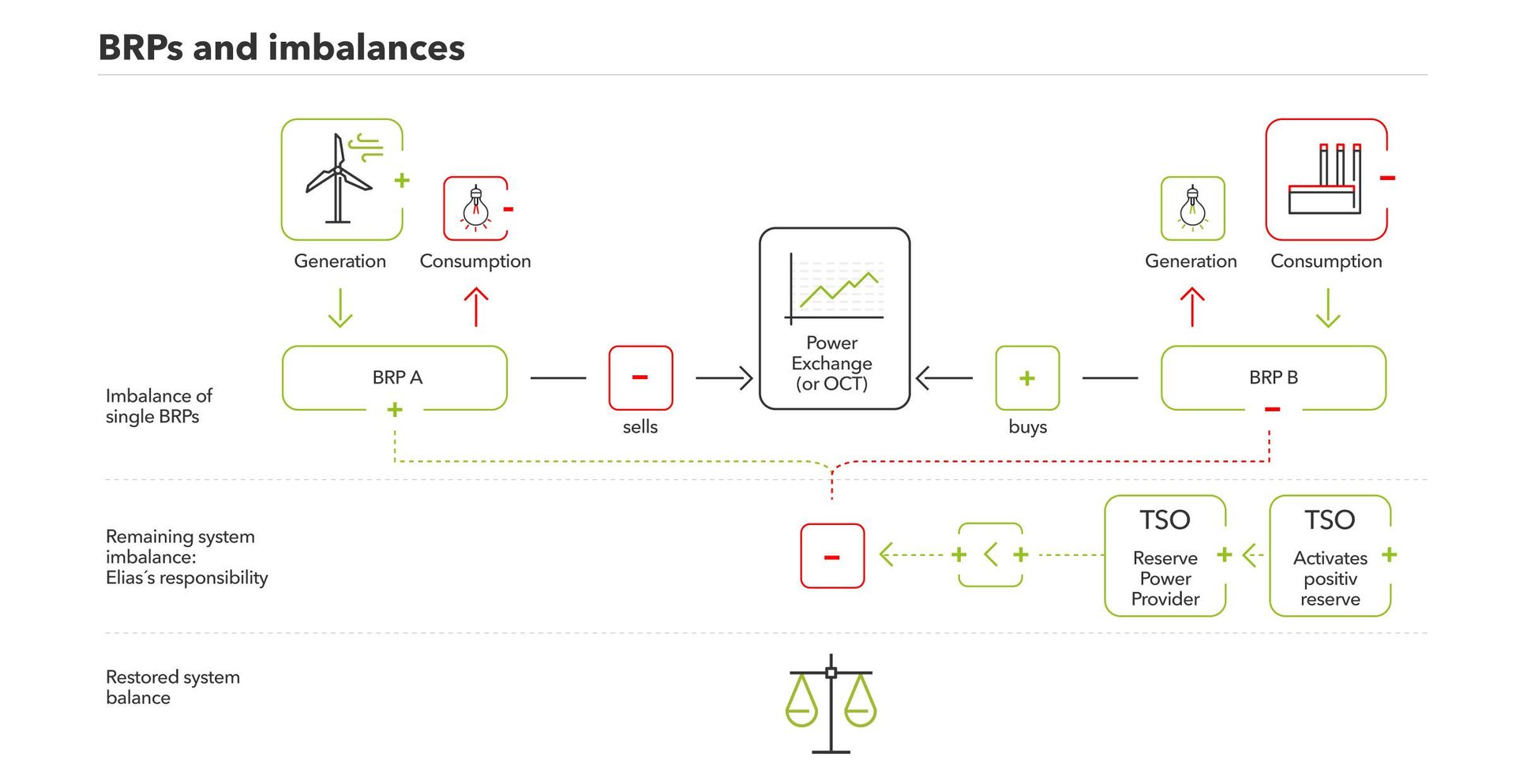

As for BRP A in the graph below, the high wind farm production and low energy consumption might create an excess imbalance. At the same time, there might be another BRP B which has a shortage with respect to its original nomination. This might be caused by an outage in the production plant of their balancing group and a higher consumption by a factory in the balancing group. In the power exchange, both BRPs can trade to compensate their imbalance as good as possible. It might indeed be more cost effective to solve the imbalance by trading an excess or shortage of energy rather than taking measure within the own balancing group.

The total imbalance that is not settled is resolved by Elia via its contracted reserve power providers. The reserve markets are discussed in more detail here.

Imbalance pricing system

As illustrated in the example above, an imbalance arises when a BRP's portfolio is unbalanced. This can be because injection exceeds demand (a positive imbalance) or vice versa (a negative imbalance). In order to encourage BRPs to do their homework and keep their portfolio in balance, Elia imposes an imbalance tariff on all BRPs that are in imbalance.

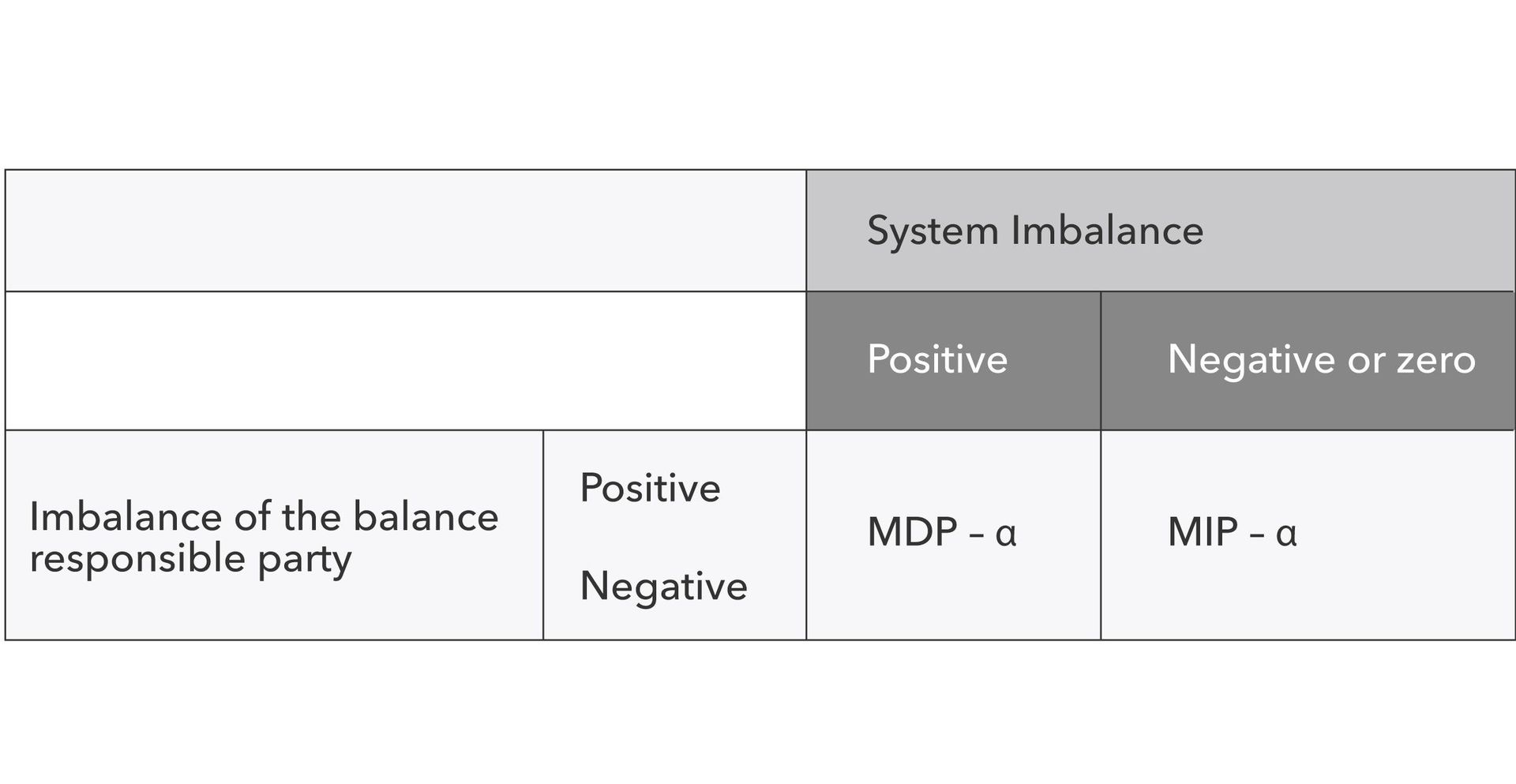

The imbalance charges reflect the cost to Elia of redressing the overall system imbalance, for which it has to use balancing energy. To this end, the following two prices are defined on a quarterly basis:

- The MDP or Marginal Decremental Price, which is the price of the last (and therefore most expensive for Elia) activated downward balancing bid (this can be an aFRR or mFRR bid)

- The MIP or Marginal Incremental Price, which is the price of the last (and therefore most expensive for Elia) activated upward balancing offer (this can also be an aFRR or mFRR bid)

Elia has been operating a symmetrical imbalance tariff since early 2020. This means that the price for a positive and negative imbalance are equal. However, the payment direction has been reversed: BRPs that consume more or inject less than anticipated pay the imbalance tariff to Elia, while BRPs that consume less or inject more are reimbursed by Elia. It may sometimes happen that the MDP or MIP are negative, in which case the normal payment directions are reversed.

The methodology is shown in the table below.

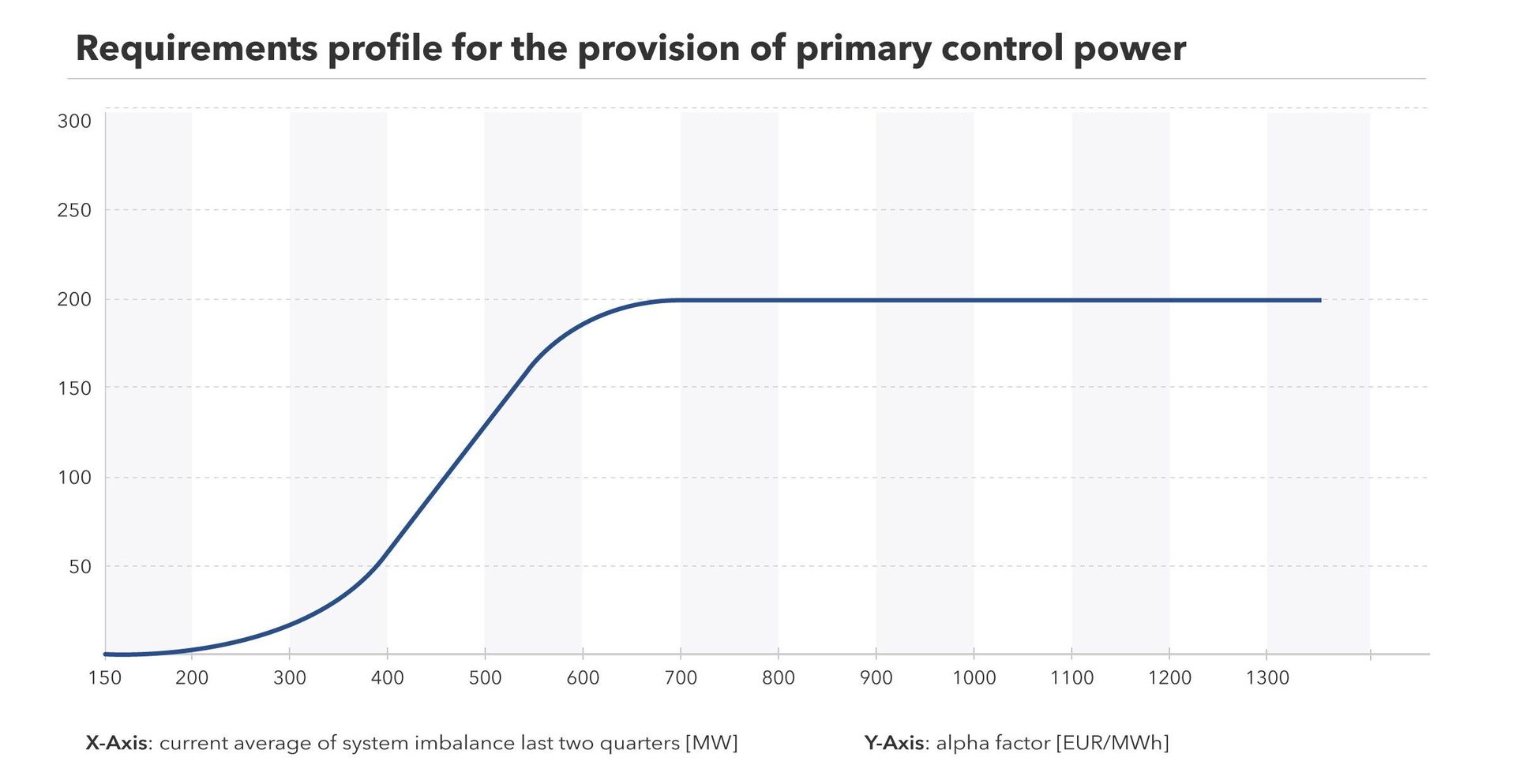

The alpha factor is a correction factor applied as an additional incentive for BRPs to maintain a balanced portfolio in cases of structural imbalance in the Belgian grid. A structural imbalance occurs when the system imbalance exceeds 150 MW. The alpha factor increases exponentially as a function of the running average of the system imbalance in the last two quarters and flattens out at around EUR 200/MWh. This is shown in the graph below. For system imbalances below 150 MW, the alpha factor is 0.

More to read

Disclaimer: Next Kraftwerke does not take any responsibility for the completeness, accuracy and actuality of the information provided. This article is for information purposes only and does not replace individual legal advice.